what is tax planning explain its characteristics and importance

The result can be a reduction in the effective tax rate paid leaving more cash for other purposes. Discuss the objectives importance.

Planning And Decision Making Characteristics Importance Elements Limitations Studiousguy

It basically means being responsible with your finances and keeping track of all your income and expenditure right from the beginning of the financial year.

. I Reduction of tax liability. Ad An Edward Jones Financial Advisor Can Partner Through Lifes MomentsGet Started Today. Visit The Official Edward Jones Site.

Tax planning refers to financial planning for tax efficiency. Ad Browse Discover Thousands of Book Titles for Less. This helps you legitimately avail the maximum benefit by.

Compliance regarding tax payment reduces legal hassles. Each year the tax law becomes more and more complex and with that complexity comes more opportunities to potentially reduce your tax liability arise. New Look At Your Financial Strategy.

A perfect example is when the Tax Cuts and Jobs Act was passed and reduced the corporate tax rate from 35 to 21. Know more by clicking here. It aims to reduce ones tax liabilities and optimally utilize tax exemptions tax rebates and benefits as much as possible.

While this was common knowledge due to. Want to know more about why tax planning is important. Proper tax planning brings economic stability by various techniques such as mobilizing resources for national projects or availing ways for investments which are productive in nature.

Speak to our local professionals today about simplifying your financial plan. Hence the objective of tax planning cannot be regarded as offending any concept of the law and subjected to. Tax planning measures involve generating white money that flows freely and results in the sound progress of the economy.

Heres a quick rundown of some of the benefits that a good tax payment. The use of tax payers is to guarantee tax effective. Tax planning is the development of a strategy for minimizing or delaying an entitys tax burden within the structure of its financial and operational plans.

Tax planning facilitates the smooth functioning of the financial planning process. Tax planning is a process of analysing and evaluating an individuals financial profile. In other words you want to reduce what you owe on your tax bills by taking advantage of any allowances exclusions exemptions and deductions.

Understand the objectives of tax planning in India and its various types along with their benefits and importance. Tax Planning allows a taxpayer to make the best use of the different tax exemptions deductions and benefits to minimize his tax liability each financial year. Ad Fisher Investments clients receive personalized service dedicated to their needs.

Tax planning helps you save money. Tax planning refers to the process of minimising tax liabilities. Tax planning should also consider how to reduce payroll and self-employment taxes.

Tax planning is the practice of using effective strategies to delay or avoid taxes. It facilitates the coordination of. What is tax planning.

Tax Planning is the logical analysis of the current situation of an individual. Planning is firmly correlated with discovery and creativity. 8 What is tax planning explain its characteristics and importance.

Good tax planning can help determine the best year to deduct losses. Every taxpayer wishes to retain a maximum part of the earnings rather than parting with it and facing the resource crunch. What is Tax Planning.

You find ways to accumulate and speed up tax credits and tax deductions. A similar theory applies to capital loss carry forwards. Tax planning allows all elements of the financial plan to function in sync to deliver maximum tax efficiency.

Tax planning helps channelize taxable income to various investment plans. Tax planning is no rocket science. For business owners this means looking both at company taxes as well as personal taxation.

What does tax planning mean. Tax planning allows all elements of the financial plan to function in sync to deliver maximum tax efficiency. Tax planning is critical for budgetary efficiency.

Objectives of Tax Planning. Tax rates are constantly changing too. Tax planning is defined as a set of patterns that optimize the tax burden to reduce or eliminate it as well as to obtain different tax benefits.

Investors analyses and invest in those that provide a better rate of return at lower risk. Tax planning involves applying various advantageous provisions which are legal and entitles the assessee to avail the benefit of deductions credits concessions rebates and exemptions. Features and Limitations of Planning.

This way you can use an income tax calculator and make. It ensures savings on taxes while simultaneously conforming to the legal obligations and requirements of the Income Tax Act. It would be in the interest of assessee to _plan the tax affairs properly and avail the deductions exemptions and rebate admissible under the Act.

What is Tax Planning. The term tax planning refers to the technique used for analyzing the financial situation of an individual to design investment and exemption strategy with the objective of ensuring optimum tax efficiency. When you sit down and make a tax plan with your tax planning advisor you look at ways to defer or avoid taxes by taking advantage of provisions in the tax law that benefit taxpayers.

Tax planning enables corporates to contribute towards. Good tax planning always considers the non-tax aspects of the circumstances and merges tax laws with financial prudence. Ad 4 Simple Steps to Settle Your Debt.

Tax planning includes making financial and business decisions to minimise the incidence of tax. The Importance of Tax Planning May 21 2021. It implies that you must understand the persons earnings requirements and expenses.

Tax planning is critical for budgetary efficiency. Read more Best Tax Saving Plans High Returns. Here are the key advantages of tax planning.

Tax planning is a process of analyzing ones financial situation logically with a view to reducing tax liability. A sound tax plan requires all the elements of a financial plan to work in unison in the most tax-efficient way. In this regard such planning becomes a useful tool for the company in terms of its management ie concerning decision-making to optimize its resources.

Importance of Planning. A reduced tax liability and maximized the ability of retirement plans. Tax planning is the logical analysis of a financial position from a tax perspective.

This will enable you to properly plan the finances and save money for your future needs. The objective behind tax planning is insurance of tax efficiency. Several tax planning strategies are noted below.

Most Important Job Functions In 2022 For A Procurement Department

Staffing Definition Nature Importance Mymcqhub Training And Development Business Management Staffing

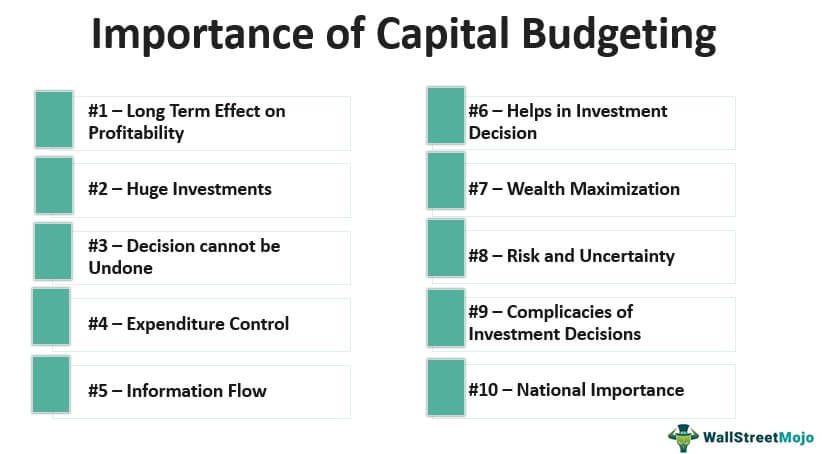

Capital Budgeting Importance List Of Top 10 Reasons With Explanation

Importance Of Tax Planning For Corporates And Individuals

Planning And Decision Making Characteristics Importance Elements Limitations Studiousguy

Stepbystep Finance Budget Money Free Freedom Tips Tiptuesday Amazing Read Ideas Learn Basic Investing Infographic Investing Finance Investing

Process Of Controlling Mymcqhub

Vertical Diversification Meaning Types Examples And More

Big Data Analytics Powerpoint Template Designs Slidesalad

Planning And Decision Making Characteristics Importance Elements Limitations Studiousguy

Public Finance Overview Example How Government Finance Works

Tax Planning Meaning Importance It S Benefits Edelweiss Mf

Behavioural Functional And Technical Skills

Income Tax Multiple Choice Questions Mcq With Answers Updated Income Tax Income Tax Day

Is Apple Going To Follow In The Footsteps Of Amazon Cloud Based Services Cloud Infrastructure Cloud Services

Western Governors Universitybiology 100 Correct Answers

What Is The Importance Of Cost Estimation